Introduction

The Lunar New Year, a vibrant tapestry of traditions and festivities, ignites a spirit of renewal across Asia. Beyond its cultural significance, it plays a pivotal role in the region’s economy. The pre-celebration period sees a surge in consumer spending, travel, and festive purchases, injecting vitality into regional economies. This article delves into the Asian economic outlook in the wake of the Lunar New Year, exploring trends, challenges, and opportunities.

As the echoes of New Year celebrations still resonate, it’s opportune to cast our gaze toward the economic horizon. The post-Lunar New Year period is characterized by a sense of renewed vigor, where the foundations laid during the festivities become the springboard for economic activities. This article delves into the Asian economic outlook in the wake of the Lunar New Year, exploring the trends, challenges, and opportunities that will shape the regional landscape in the coming months. From the boardrooms of bustling metropolises to the bustling markets echoing with the spirit of commerce, Asia is on the rise, poised for a year of economic resurgence and transformation.

Lunar New Year Economic Impact

Families celebrate with a surge in spending, creating a ripple effect across industries. Retailers offer festive promotions, the hospitality sector experiences increased demand, and digital commerce thrives with online red envelope exchanges and e-commerce platforms. This shift towards digital transactions streamlines processes and opens new avenues for engagement.

- 52% of respondents from Mili Survey expect that their overall spending for Lunar New Year this year is likely to be higher than the last. Despite the inflation, the intention to spend on each category remains largely similar to last year’s.

- In most Southeast Asian countries, majority of people are looking forward to celebrating Chinese New Year in the home countries

- Whereas in Singapore, 12% intend to spend the extended holiday overseas (Source: Mili Survey Result)

This surge, akin to a cultural and economic ripple effect, manifests in various industries, each touched by the hand of prosperity. Retailers, keenly attuned to the festive spirit, craft promotions and thematic sales that resonate with the joyous occasion. Meanwhile, the hospitality sector experiences a palpable increase in demand as families embark on joyous reunions and travelers seek memorable experiences, painting the town red with economic vigor. The reverberations of Lunar New Year celebrations become the driving force behind economic activities, shaping the trajectory of industries in the post-celebration period. However, this economic impact doesn’t merely unfold in traditional brick-and-mortar spaces.

Key Economic Indicators

In the context of the “Key Economic Indicators” section, indicators refer to various quantitative metrics that provide insights into the economic performance of a country or region. These indicators are typically used to assess the health and stability of an economy. Common economic indicators included Gross Domestic Product (GDP) & Inflation Rate:

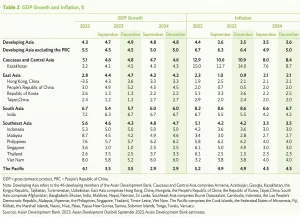

Source: https://www.adb.org/sites/default/files/publication/931316/ado-december-2023.pdf

Gross Domestic Product (GDP) and inflation rates are crucial indicators of economic health. Analyzing pre-Lunar New Year GDP changes offers insights into economic vibrancy, while inflation rates influence consumer behavior and business strategies. Employment rates also shed light on the labor market dynamics and growth potential. Examining these indicators across major Asian economies reveals disparities and similarities, providing a nuanced understanding of the regional landscape.

Regional Trade and Investments

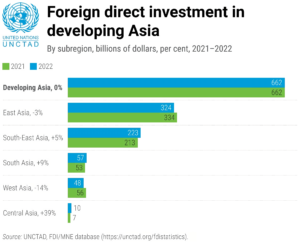

Asia’s economic landscape is interwoven with global trends, with foreign direct investments (FDI) and economic partnerships playing key roles. UNCTAD’s World Investment Report 2023 highlights the concentration of FDI inflows, with nations actively fostering collaborations through bilateral agreements. Examining FDI patterns and partnerships reveals the strategic positioning of nations and industries drawing international interest.

source: https://unctad.org/news/investment-flows-developing-countries-asia-remained-flat-2022

In this complex economic ecosystem, foreign direct investments (FDI) and economic partnerships emerge as key drivers shaping the regional landscape. A closer examination provides valuable insights into the strategic initiatives that mold the economic terrain. UNCTAD’s World Investment Report 2023 sheds light on the concentration of FDI inflows, with five economies accounting for almost 80% of foreign direct investment to the region. Over the past five years, FDI flows increased across major economic groupings in developing Asia, particularly in the member States of the Association of Southeast Asian Nations, which saw a remarkable 41% growth to reach $222 billion. Noteworthy sectors relevant to the achievement of the Sustainable Development Goals experienced a surge in investment, with China and Hong Kong leading as the largest investors in the region, followed by the United States, Japan, and Singapore (Source: UNCTAD).

Government Policies and Initiatives

Government policies set the tone for economic activities. Analyzing initiatives designed to stimulate growth offers a comprehensive view of proactive measures taken to bolster economies. Governments face continuing inflationary pressures and a global economic slowdown, requiring strategic policy responses. As they navigate these challenges, their economic policies and initiatives gain added significance, guiding businesses and investors in the evolving landscape.

The global economic slowdown, driven by uncertainty and weakened demand for Emerging Asian goods, further emphasizes the need for strategic policy responses. Governments must contend with supply-side bottlenecks that emerged during the pandemic and persist due to global uncertainty. Simultaneously, the imperative to establish tourism as an engine of growth post-pandemic requires adaptations and enhanced flexibility in government policies. (Source: OECD Asia Pacific)

As governments across Asia navigate these multifaceted challenges, their economic policies and initiatives gain added significance. This comprehensive examination of government actions not only elucidates their strategic vision but also serves as a guide for businesses and investors seeking to align their strategies with the evolving policy landscape.

Technology and Innovation

Southeast Asia’s digital economy companies (DECs) are poised to play a central role in the region’s economic transformation. The increasing importance of responsible product design and services reflects a broader shift towards sustainability and ethical considerations. DECs have the potential to design and implement responsible technologies that align with ethical principles, advancing both economic growth and sustainability.

The imperative for responsible and transformative technologies becomes particularly pronounced in the quest for sustainable solutions. This dual focus on creating value and advancing sustainability underscores the interconnectedness of technological advancements with broader societal goals. DECs, as harbingers of digital innovation, have the potential to lead the way in fostering economic resilience while simultaneously championing sustainability initiatives. This alignment of technological progress with responsible and transformative practices represents a dynamic force in shaping the trajectory of Southeast Asia’s digital economy. (weforum)

Challenges and Risks

Navigating the post-Lunar New Year economic landscape in Asia unveils not only opportunities but also a spectrum of challenges and risks that demand careful consideration. The identification of potential challenges faced by Asian economies involves a comprehensive analysis of obstacles that may hinder sustained growth. Diverse cultures and languages create a complex business environment where effective communication and cultural sensitivity become paramount. Local competition, another significant challenge, requires businesses to navigate dynamic markets, adapt to local preferences, and differentiate themselves to thrive in a competitive arena. (Source: Challenges of doing business in Asia)

Infrastructure and logistics pose additional hurdles, with varying levels of development across the region. Businesses must contend with diverse transportation networks, technological capabilities, and logistical complexities. Intellectual property concerns add a layer of intricacy, as safeguarding proprietary innovations becomes essential amidst differing legal frameworks and enforcement mechanisms.

Opportunities for Investment

The post-Lunar New Year period unveils a landscape ripe with investment potential. Identifying sectors with growth potential and industries experiencing a surge in demand becomes paramount. Investors can leverage insights from free trade agreements, tax holidays, and special economic zones, and capitalize on the region’s burgeoning consumer class and technological advancements, particularly in fintech and financial services.

Conclusion

The post-Lunar New Year period in Asia presents a harmonious interplay of cultural traditions and economic vitality. The region’s resilience, coupled with opportunities in emerging markets, technological advancements, and responsible practices, sets the stage for a robust recovery and sustained growth. By understanding these trends, businesses and investors can navigate the evolving landscape and unlock shared success.

Let’s commence on a collaborative journey to navigate the Year of the Wood Dragon and unlock shared success. Contact us (www.calendly.com/annecheng) for a discussion on the tailored opportunities that align with your goals.